Survey: Retailers Reveal Best Practices in Ecommerce

Retailers put endless pressure on themselves to create the perfect shopping experiences for customers — as they know customers will punish brands that don’t. This has retailers constantly tweaking and measuring outcomes to seek ways to improve. But what is aspirational and what is realistic?

As a company that powers so many of the largest retail brands — including four of the top 5 home improvement stores, we often get asked best practices in ecommerce. To get into the minds of the largest brands we commissioned a study that looked at three pillars that have become crucial to customer experience: Product Findability, Personalization, and Site Performance.

We chose these because research shows that customers who use search are ready to buy, but that 80% of those searches fail because sites rely on simple keyword search. Providing greater relevancy requires brands to analyze what people are searching for, then optimize synonyms lists, business rules, ontologies, field weights, and countless other aspects of their search configuration.

The survey results share how brands are tackling those initiatives.

Commerce Survey Methodology

We conducted our survey in conjunction with a retail publisher as we felt that would assist both from a methodology and credibility standpoint. We had a lot of questions we wanted to ask — but erred on the side of brevity so that it wouldn’t take more than 4-5 minutes to complete.

Because this was our first survey, we actually went more narrow in focus. We created a floor of $100m in annual sales in order to participate and limited it to companies selling physical products (vs services, or digital goods like reservations, tickets, or subscriptions). The surveyed attracted 123 participants who qualified to share the collective concerns of their brands.

Survey Results

The survey establishes benchmark KPIs such as add-to-cart (ATC) percentage and click-through-rate (CTR), and outlines top concerns such as performance, product findability, and customer experience. It also demonstrates that retailers are adopting AI-powered tools at a relatively high rate, but still have room to improve on creating hyper-personalized experiences and understanding customer intent. Many of these steps are still being done manually.

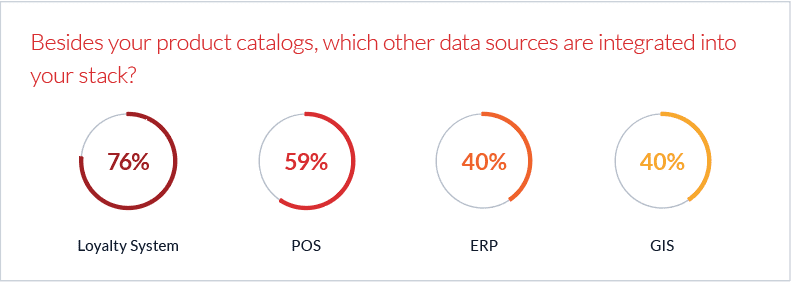

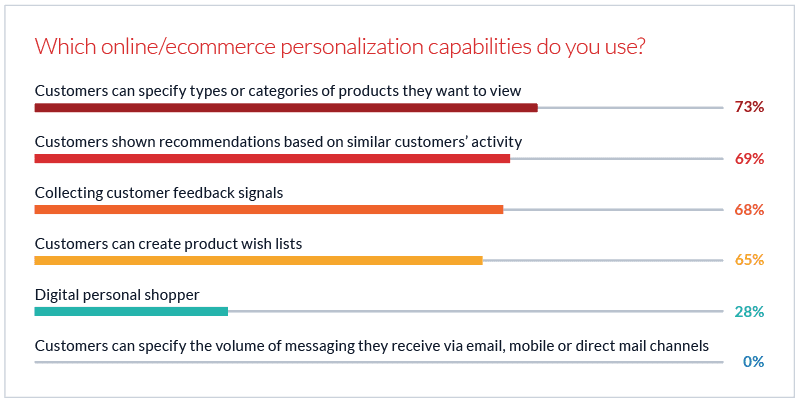

We also asked what types of data are being incorporated to refine search. Loyalty systems are by far the most common data source brands utilize as part of their stack at 76%, with point-of-sale (POS) data at a distant second (59%). Sixty percent of shoppers visit a site up to four times before making a purchase, with 40% making five visits or more before they buy. For the 67% of retailers that are collecting customer feedback signals, each of these visits is an opportunity to better understand a customer’s intent and boost the chance of an upsell or cross-sell.

Site performance, product findability, personalized recommendations, and more, all impact whether a customer returns later, purchases, or abandons their search completely. These factors are especially critical during high volume shopping periods, including Black Friday and the holidays. Almost three-quarters (73%) of retailer respondents say downtime, degraded site performance, and poor customer experience, collectively, is their top worry during peak demand periods.

“Retailers should be evolving beyond simple keyword matches when a customer clicks into the search bar,” says Adam Blair, Editor, Retail TouchPoints. “If you’re not part of the 56% of retailers using AI and ML to power product recommendations, it’s likely that you are missing an opportunity to better serve your customers. When a customer visits a site, they want to feel like the brand knows what they would like — even before they themselves know exactly what they’re looking for.”

“That includes not just preferences such as price point, style and brand,” he continues, “but also hidden factors such as the number of visits they’re likely to make before purchase. AI-powered search engines can augment the brand’s expertise of their own product to provide a more personalized shopping experience right on the customer’s screen.”

Retailers aren’t usually technology experts. However, with new developments in AI and ML, it’s gotten easier to quickly improve site performance without being a search expert. Not surprisingly, larger retailers, those doing more than $400 million in revenue, are leading the way in adopting AI-based systems.

AI and ML are most commonly used (59%) for documentation classification, assigning an item to a specific category to make it more easily discoverable. Less than half of all respondents (49%) use artificial intelligence for query intent detection, and only 46% use it to power anomaly detection, a feature merchandisers and marketers rely on to track outliers and anticipate trends.

Other key findings include:

- Average add-to-cart percentages

- Average click-through-rate

- Speed to update online inventory catalog

- Most commonly deployed AI and ML capabilities

- Adoption of recommendations based on similar customers’ activity

Download the Best Practices Survey Report. We’d love to get your feedback. And next year, we hope to widen the survey to companies of all sizes and include B2B, D2C, and digital goods and services.

DOWNLOAD the BEST PRACTICES REPORT

LEARN MORE

Contact us today to learn how Lucidworks can help your team create powerful search and discovery applications for your customers and employees.